Perhaps you're wondering why I've chosen today's topic, thinking it might not be mainstream. However, I genuinely believe it needs attention. These subjects have always fascinated me, particularly after my experience with a food company here in Japan. In today's newsletter, I've highlighted 4 FoodTech companies that have gained some popularity here, yet remain relatively unknown globally. For example some have pioneered innovative cloud software on managing herd, while others utilize food waste to nourish algae. Surprisingly, there's even a Vegan Dashi Sauce available. (Dashi is a fundamental ingredient in Japanese cuisine, traditionally derived from bonito fish.)

Before delving into these companies, I'd love to share some insights about the Japanese market. Having spent 6 years here, I've observed it's a profoundly hierarchical society with many businesses operating on an oligopoly model. The market landscape is such that foreign brands often face challenges establishing a presence without the right local connections.And the only way seems that worls is to navigate through the influential Sogo shosha (総合商社) which are general trading companies but very powerful. Sogo Shosha is very famous in Japan for handling international trading because their operations in diverse markets and currency balances enable risk management. They benefit from economies of scale due to extensive in-house market information systems, which aid in identifying new opportunities. Moreover, their vast scale allows them to offer credit, financing, and export services cost-effectively. Some famous examples which you may have heard are conglomerates like Mitsubishi, Mitsui and Itochu. However, Japanese market is a challenge not only to international entities but to the locals too. Numerous Japanese startups and venture funds remain under the global radar. Potential barriers like English language differences and an already dominant domestic market fulfilling their revenue objectives contribute to this.

A defining feature of Japan's food industry is its loyalty to their tradition, ensuring that the essence of flavors is consistently authentic and passed across generations. Yet, Japan struggles with issues like food waste and an aging demographic, prompting a search for groundbreaking tech innovations.

Now, you might ask, "What exactly is FoodTech?"- It's a blend of food and technology, reshaping the industry from production to logistics. As technology evolves, the FoodTech sector is flourishing, paving the way for more job opportunities.

With society aging quickly, there's a growing shortage of human resources. Food tech offers a solution to this challenge. Take Uber Eats for example: by utilizing smartphones, it matches delivery personnel with orders, ensuring restaurants are properly staffed. Therefore, incorporating food tech can benefit both consumers and businesses. Farmers on the other hand, for example, can efficiently track product demands and distribution.

Additionally, FoodTech can significantly address food waste by accurately calculating production demand. By doing so, it prevents overproduction, ensuring that only the necessary amount of food is produced, thereby minimizing wastage. With this method for example, retail stores and restaurants can better anticipate consumer demand. This optimization prevents the overproduction of pre-made products. With a more accurate gauge of ingredient needs, producers can minimize oversupply, cutting down on food wastage. Reinforcing this point, a 2017 study disclosed that Japan discarded an astonishing 6.12 million tons of edible food annually.

Currently, the food tech market is on an upward trajectory. As of 2020, it stands at 24 trillion yen, but projections suggest a surge to 279 trillion yen by 2050. To put this into perspective, the Ministry of Agriculture, Forestry and Fisheries indicates that this is more than a tenfold increase over 30 years. When compared to the traditional food market, which is projected to merely double from 234 trillion yen in 2020 to 493 trillion yen in 2050, the growth potential of FoodTech is evident.

Source: Ministry of Agriculture, Forestry and Fisheries “Market Survey on Food Tech”

Now, let’s explore the 4 startup companies.

Farmnote:

Founded in Obihiro, Hokkaido, in 2013, Farmnote initially began as a venture for a web application development company. Now, with branches in Tokyo, Sapporo, and Kagoshima, the company has evolved immensely.

Farmnote's flagship service is a herd management app, tailored for dairy and livestock farming. This innovation led the company to become one of the fastest-growing entities in the food tech sector. In 2019, they secured a whopping 850 million yen in funding. Living by their mission to "Create the world's agricultural brain," the company foresees a global footprint in the near future.

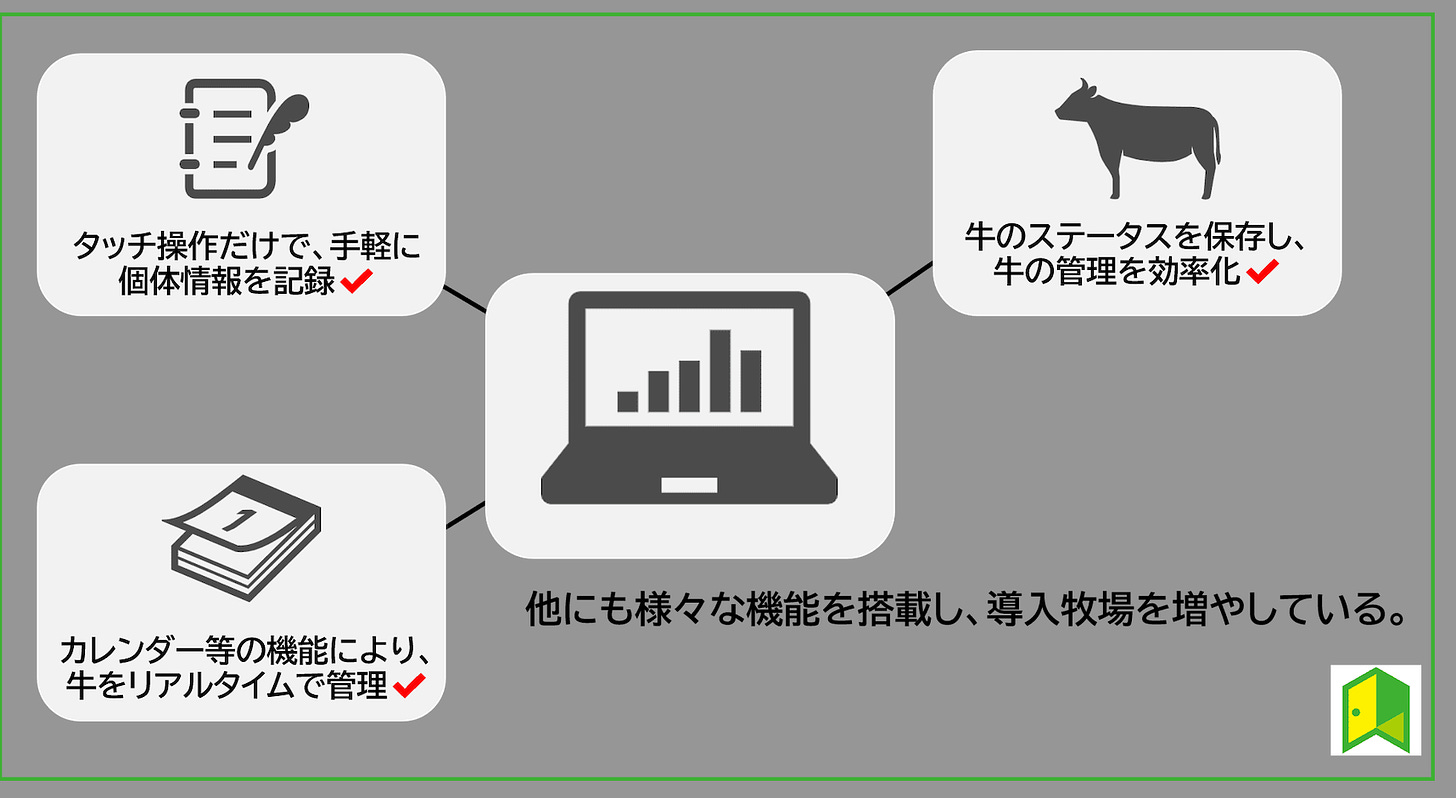

Their app, also named "Farmnote", is designed to modernize the traditional cattle management process. It operates by attaching a sensor to the cow's neck, enabling farmers to monitor vital data such as estrus cycles and calving times, all conveniently from a PC.

Historically, such data was recorded manually on paper ledgers. But as farm sizes grew, so did the administrative tasks. Recording and tracking information for a growing number of cattle became time-consuming. The "Farmnote" app simplifies this with easy touch operations, streamlining management tasks.

Additionally, "Farmnote" centralizes key data, including individual animal conditions, shipment dates, and destinations. Its efficiency and ease-of-use make it particularly appealing to larger farms. Considering the challenges the dairy industry faces, like manpower shortages and rising costs, the adoption of such innovative technology is bound to gain traction nationwide.

Plantio

Plantio is an innovative startup championing the concept of "urban farming" – the practice of cultivating agriculture within cityscapes. They provide IoT-( AI agri sensor) equipped planters and communal farming spaces, as they explore novel approaches to food production and agriculture.

CEO Serizawa's concerns about the challenges facing Japanese agriculture ignited the creation of Plantio. Notably, Japan's lenient pesticide regulations have environmental implications, and the nation suffer with significant food loss. A primary contributor to this wastage is the considerable distance between production sites and consumption points. Addressing this, Plantio introduced a system enabling food production directly within urban zones, promoting local sourcing and consumption.

(The below video is an introduction of this company.)

Urban farming isn't a new concept globally. Cities like New York and London have embraced this trend before, fostering a culture where individuals grow and consume their own produce. Venturing into this global movement, Plantio collaborates with major corporations and local authorities to establish farms in urban localities. Beyond just building farms atop structures and commercial spaces, Plantio has an ambitious project in the pipeline: the world's most expansive urban farm, slated for launch in Shibuya by 2023.

Another famous example is the urban honey production in Ginza, the posh shopping district of Tokyo.The bees collect nectar from various parts of the city, creating unique urban honey. One successful company, Ginpachi is a testament to this trend. Urban beekeeping is on the rise in Japan, with locations like Hagi Iwami Airport in Shimane Prefecture producing honey and collaborating with local businesses.

Also just a fun curios :D, since we are here- Honey is the only food in the world that contains pinocembrin, an antioxidant that benefits brain health.

Agnavi

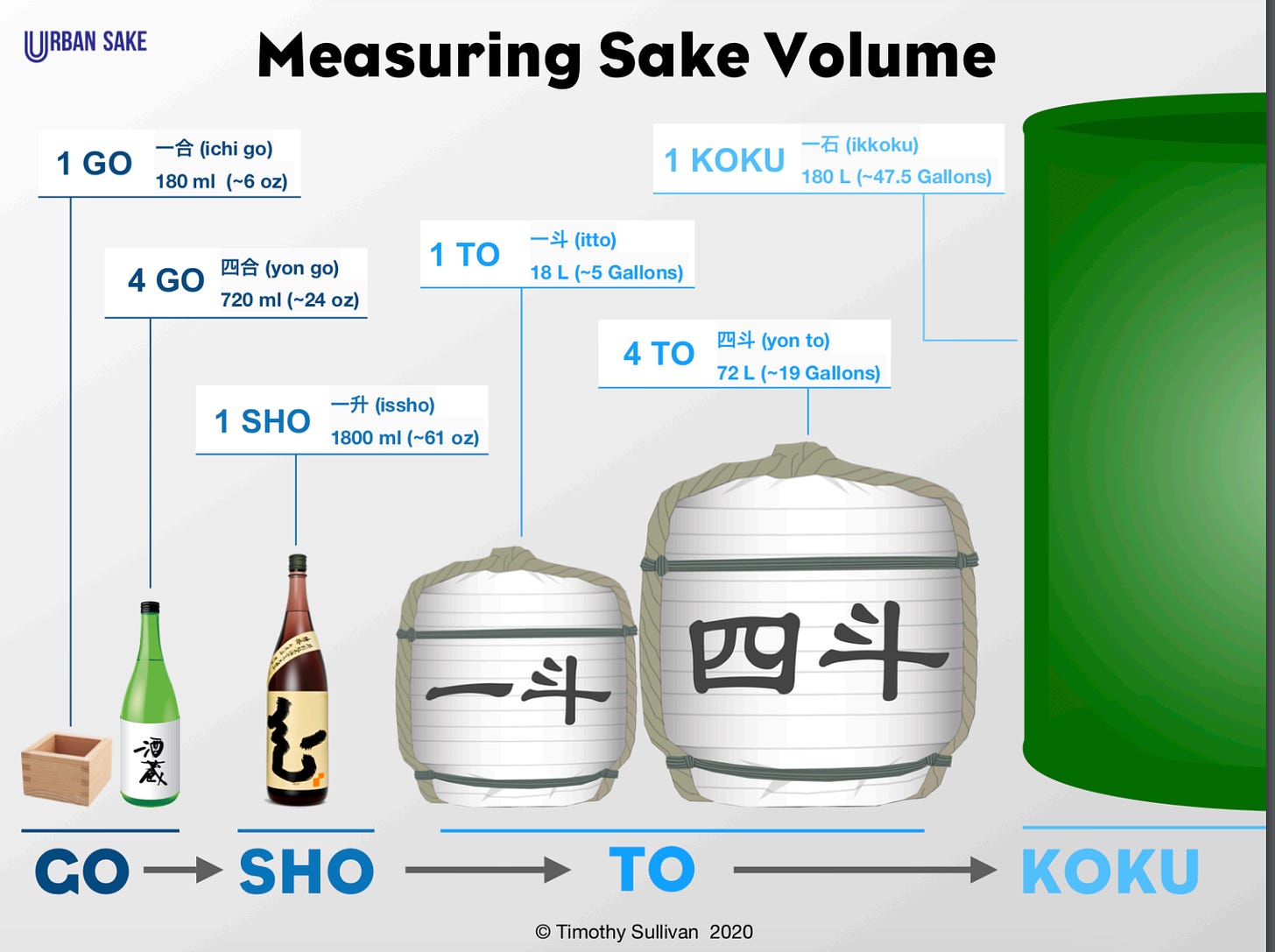

Agnavi, an innovative startup, has introduced a fresh take on traditional sake with their brand "ICHI-GO-CAN®", offering 180mL cans. Over the past 45 years, the sake market has witnessed a significant dip, shrinking by 75%. This downturn has put numerous sake breweries on the verge of ‘extinsion’. The founder of this company explains that: One contributing factor is the inaccessibility of sake. But what does this mean? The traditional bottle sizes of sake make it challenging for someone looking to sample sake for the first time. Not to mention, these bottles are bulky and cumbersome to transport. The below photo explains the volume measurement and type of bottles in Japan. As you can see is unimaginable to sample a 4-TO size.

By identifying this gap, Agnavi's founder envisioned marketing sake in user-friendly aluminium cans. He got inspired from the beer industry, which historically popularized its consumption through canning. Also, Agnavi's aim is to familiarize a younger audience with sake. With the convenience of a lightweight, easy-to-hold can, they hope to encourage more frequent purchases and reignite interest in this traditional beverage.

Below is the introductory video the this product, please check it out.

AlgaleX

Lastly, a very awesome project called AlgaleX is redefining food tech by fermenting algae and microorganisms. Their unique approach transforms discarded items, such as food waste, into valuable ingredients. A prime example is "Umamo", an algae created from awamori lees, rich in DHA and umami. This sustainable ingredient offers a plant based DHA source without overfishing. Using a fermentation technology that upcycles unused resources into sustainable products.

They've also crafted a vegan dashi soy sauce, blending Umaweed and kelp. Despite its lower salt content, this sauce promises a rich flavor, showcasing AlgaleX's dedication to both health and taste.

Reference used for this article:

https://www.geekly.co.jp/column/cat-technology/foodtech-company/

https://farmnote.jp/

https://ichi-go-can.jp/en

https://algalex.com/

https://umamo.jp/

https://plantio.co.jp/

https://www.urbansake.com/sake-101/sake-glossary/go/